X-Summit: The Event of the Year

July 8, 2024

Updated: Mar 28

We are proud to announce our recent investment in Deepwaters. We couldn’t be more excited to back this excellent team as they aim to bring maturity to DeFi and enable systems that power the next generation of financial applications. The team believes that broad adoption of blockchain technology into the applications of traditional finance will require DeFi building blocks that are equivalent to or better than existing traditional finance offerings. At Serafund we are working to incubate this version of DeFi by funding projects like Deepwaters that give everyone in the world equal access to world class financial products.

Deepwaters is building a protocol that solves some of the challenges faced by AMMs, a key component in the DeFi Ecosystem. While AMMs accelerated the rate of DeFi innovation, a few issues have made them inferior to traditional products and have led to multiple exploits. These issues include slippage, MEV (front-running and sandwiching transactions), price oracle manipulation and more. Find out more about these issues here. The Deepwaters protocol is built with a hybrid architecture with three key features designed to level the playing field for all:

Consensus-secured fair price and fair execution for traders

Modified liquidity provider positions, acting as underwriters/insurers instead of primary counterparties for capital preservation

Over-collateralized Exposure Tokens with zero-cost rebalancing

The hybrid architecture uses a mix of traditional financial and DeFi principals depending on what’s most effective for each use case. Let’s look at each of these features in more detail:

Fair Price

To understand the importance of fair price execution it is important to know how trade prices are calculated. In the absence of a centralized counterparty, orders executed on individual order books or liquidity pools are issued at the local price, which is derived from the microeconomic conditions surrounding a transaction. Lack of central price aggregation can lead to price variation on different venues.

For example, US treasury bills have a single counterparty, so the price (on the primary market) will have no variation, whereas the spot price of BTC-USD will differ on different exchanges because there is no single entity ensuring that prices on FTX, KuCoin and Binance are the same. Instead, these exchanges rely on profit-seeking arbitrageurs to keep their spot price in line with the market price.

Two microeconomic factors that may influence the local price are liquidity and order book balances. The effect of liquidity is evident in constant-product AMMs (x * y = k) when the supply of x or y differs from the optimal value, which causes the local spot price of x (k/y) or y (k/x) to deviate from the market price. Small liquidity pools and/or large trade volumes are extra susceptible to local price variation in AMMs, which can cause price slippage for traders. Order book imbalance occurs when there is a difference in the best bid and best ask on open trades on a hard central limit order book (CLOB). If there is no counterparty to a trade, even at the market price, the trade won’t be executed unless the price adjusts. If the market price of BTC was 31,000 but all buyers on an exchange stopped placing BTC orders above 30,000, the execution price on that exchange would fall below 31,000 as no seller would have a buyer, resulting in a lower local market price.

While some traders may benefit from a local price that is ‘better’ than the market price (lower on the buy side, higher on the sell side), these variations are ultimately zero-sum. Each gain comes directly at someone's’ expense. In theory, averaging all available prices at a point in time would give the market price, and the sum of all price variances should equal zero.

Deepwaters aims to offer fair price execution on their platform. The fair price is the best approximation of global macro conditions represented by the average price of an asset across many venues. This fair price is protected by their consensus mechanism and aims to reflect the accurate market price for a desired transaction at a given time.

Fair Execution

In addition to fair prices, Deepwaters also offers fair execution. Both traditional and decentralized finance suffer from toxic flow - where some parties have privileged speed or access to information. This gives an unfair advantage to those who pay more for special privileges and creates an execution risk for regular users on the platform.

In DeFi, toxic flow manifests as Miner Extractable Value (MEV), where value is extracted through validators reordering and censoring transactions in blocks. They are incentivized to reorder trades in ways that benefit arbitrageurs who pay higher fees. In traditional finance (or centralized exchanges with a similar architecture) this is seen in payment for order flow (PFOF): privileged takers have the ability to view unexecuted orders and act on them before others.

The protocol uses a consensus-backed queue of trades that eliminates all toxic flow. This ensures that trades are issued in the order of submission and gives no opportunities for anyone to have an unfair advantage - leveling the playing field for all.

Liquitity Underwriting

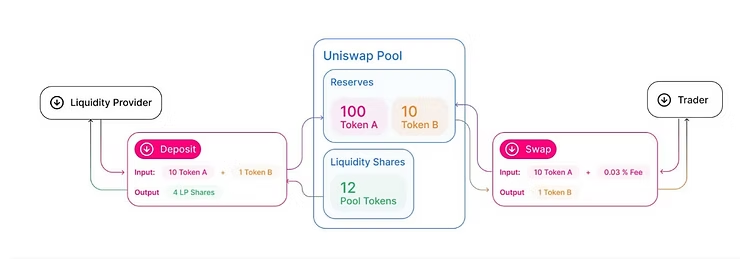

In a traditional AMM structure, liquidity providers (LP) deposit assets into a pool. Traders can swap their assets for a fee, which is paid to the LP as a reward. However, by design, LPs are exposed to price risk and impermanent loss. LPs generally only make good profits in certain market conditions, depending on volatility, volume, and the design of the pool itself. This disincentivizes people from providing liquidity in most market conditions, which results in less liquidity and worse prices for traders.

If the price of token A or B increases or decreases from the deposited price (typically a result of trading activity in the pool) the LP will be exposed to Impermanent loss. These price variations can benefit traders and arbitrageurs but are harmful to LPs if they exit their position before the price returns to its original value.

Deepwaters aims to solve this problem by using their liquidity pool for insurance on transactions, rather than as the primary source of exchange. LP assets are not the first assets traded against, so they are exposed to less IL. Once a trade is submitted, the arbitraging counterparty (AI matching coincidence of wants) scans all venues for a party who is willing to match the trade - just like a traditional order book. If the trade cannot be matched immediately, it is broadcast to the rest of the network in search of a taker. If there is no match, liquidity can be sourced from other areas in the protocol to match incoming order flow. The LP assets will only be used if all of the prior methods can not fill the incoming order. Irrespective of whether their assets were used in a trade or not, LPs still earn a portion of the trading fees.

“LP assets are only used as liquidity of last resort, reducing risks and preserving capital.”

Exposure tokens and Zero cost rebalancing

Deepwaters protocol also offers users exposure to a basket of assets through Exposure Tokens. Exposure Tokens have a particular theme of underlying assets (blue chip, gaming, governance, etc.). These tokens act similarly to an index fund. Holders will be exposed to a variety of assets within the given domain. Token composition and target allocations are set by community governance. Through the platform’s WTR governance, users can vote to add and remove assets or adjust allocation targets. The protocol automatically rebalances compositions to maintain these allocations, doing so at zero cost.

An Exposure Token’s composition will become imbalanced with market fluctuations (current asset allocations deviate from target allocations) and must be rebalanced to return to its target allocations. The rebalancing is mutually beneficial to the Deepwaters ecosystem and helps to fill incoming order flow by providing more liquidity for swaps (this is one of the alternate sources of liquidity mentioned above).

Below is a hypothetical Exposure Token mix, composed of 5 blue chip assets A-E. If the price of A decreases and all others remain constant, the pool will automatically sell a portion of assets B-E and buy more A to ensure the portfolio is still composed of 30% A at the current market value. While relatively simple in theory, complex algorithms and reliable price discovery mechanisms are required to maintain the required composition at all times. This sale of tokens B-E increases the available liquidity for swaps on the platform, further protecting LPs from impermanent loss.

System architecture

The Deepwaters financial ecosystem is positioned as a ‘middleware layer' that is protected by its own consensus mechanism. The system utilizes on-chain and off-chain transactions depending on the use case, choosing the best practices for each one. Orders are finalized on chain ensuring security and transparency, but most computations are handled off chain, reducing the L1 blockchain’s computational load.

Similar to layer two scaling solutions that increase throughput without sacrificing trust, Deepwaters uses a rollup mechanism on multiple supported blockchains. Transactions are matched and executed off-chain, achieving consensus within the Deepwaters network. Ultimately this batch of rolled up transactions are confirmed on their respective origin blockchains in a single transaction. This decreases congestion on the main chains while preserving transparency and security, as consensus is achieved at both layers. This provides comparable capital efficiency to ZK rollups and transparency to Optimistic rollups.

The network also fares quite well on fees. Users only pay transaction fees when transferring funds in and out of Deepwaters accounts. Trading fees start at 0.10% and progressively trend to zero as the system matures, due to economies of scale. The hybrid architecture with rollups allows for reduced fees instead of immediate on-chain settlement, making it cheaper to use the network, increasing accessibility and practicality for all.

Conclusion

Deepwaters is building a system that is drastically different from the other DeFi protocols by combining features from traditional financial markets with DeFi architectures. This infrastructure will provide anyone in the world with world class financial services that are capital efficient, cheap, and fair.

In order to onboard the next generation of users into the DeFi ecosystem, products have to be fair, simple, secure, and comparable or better than traditional financial services. These are some of the core principles that have guided the team at Deepwaters throughout the development of their product. I am excited to be part of one of the many funds backing this protocol and will certainly be a power user when Deepwaters goes live on mainnet (scheduled for Q4 2022).

The contents of this article are representative of my independent research and are not intended to be taken as financial advice. Do your own research and talk to a financial advisor before investing in volatile assets such as cryptocurrencies. None of this material represents the views of Serafund or any of its affiliated organizations.