Visionaries in Villette: The X Summit 2025:

July 25, 2025

[Download the reprot directly above for optimal reading experience]

What is DeFi?

Decentralized Finance (DeFi) is an emerging sector for financial services within blockchain ecosystems. Unlike traditional financial systems, which rely on intermediaries, DeFi empowers individuals with peer-to-peer digital exchanges. It eliminates fees charged by financial institutions and allows individuals to securely hold money in digital wallets, transfer funds quickly, and access financial services without the need for a centralized authority. DeFi offers various benefits such as financial inclusion, openness, flexibility, cross border settlement speed, and transparency. Users engage with DeFi through decentralized applications, enabling activities like lending, borrowing, trading spot and derivatives, and saving.

While DeFi provides numerous advantages, it is important to consider factors such as transaction costs, volatility, and fragmented regulations across different regions. Overall, DeFi represents a disruptive and accessible alternative to financial services, offering individuals greater autonomy and access to global markets.

Market Size

Figure 1

(Source: DeFiLlama)

As of May 31st, 2023, the Total Value Locked in DeFi applications sits at roughly $60.5 Billion after peaking at $242 Billion in December of 2021.

TVL, or Total Value Locked, is a metric used in DeFi to measure the total value of assets invested or locked in a specific protocol. TVL typically provides insights into the popularity, adoption, and potential of a DeFi platform, serving as an indicator of user trust and the platform's ability to generate returns and offer financial services. The Market Cap/TVL ratio is another metric that uses TVL to provide insight into a protocols total value (market cap) relative to its traction and adoption (TVL).

Figure 2

(Source: DeFiLlama)

Currently, over 90% of the DeFi market TVL is made up of 8 main categories of protocols (Figure 2). Within this report we will dig deeper into some of these sectors of DeFi and outline what they are, the value and opportunity they provide to DeFi users, and the traction these sectors have seen since their inception.

Liquid Staking Derivatives

What are LSDs?

The act of staking is when tokens are delegated for the use of network consensus, typically associated with a minimum stake requirement and/or lock-up period, through which they receive an ROI as a result of network fees. Liquid staking derivatives are tokenized staked assets in a blockchain network. They are designed to provide flexibility and liquidity to those who stake their assets while enabling them to use their staked assets in other ways, allowing for greater leverage and capital efficiency.

Liquid staking derivatives address opportunity cost associated with locking up assets for a specific period of time. This limitation prevents token holders from taking advantage of other opportunities such as trading, lending, or using their assets in other DeFi protocols during that time. These tokenized representations confirm the staker's participation in the staking pool and can be freely traded or utilized in various DeFi protocols while still earning staking rewards.

The Value of LSDs

The importance of liquid staking derivatives lies in the enhanced flexibility and utility they offer to token holders. By tokenizing staked assets, users can access the value of their staked tokens and participate in other DeFi activities without sacrificing the rewards associated with staking. This provides greater financial freedom and maximizes the potential use of the staked assets.

Liquid staking derivatives also play a significant role in motivating token holders to participate in staking and contribute to the stability and security of the underlying blockchain network. By allowing users to earn rewards while retaining the ability to use their assets in a variety of DeFi applications, liquid staking derivatives incentivize more individuals to engage in staking activities. This increased participation strengthens the network's security and decentralization while promoting a more efficient allocation of assets within the ecosystem. Use cases for LSD tokens are protocol dependent but typically can be used in supported dapps such as lending protocols, liquidity pools, yield farming, and more.

Growing Adoption

The proof-of-stake merge of the network allowed users to stake ETH and become validators but required a minimum deposit (32 ETH) and a lock-up period. This led to the popularity of liquid staking derivatives (LSDs) as an alternative for those lacking capital or wanting to maintain the liquidity of their ETH. LSDs offer flexibility and access to additional markets, attracting more ETH holders to stake their tokens and enhance Ethereum's security and stability.

Figure 3

(Source: DUNE)

The amount of staked ETH is increasing due to the accessibility of staking through LSDs and centralized exchanges (figure 3). This allows more people to participate in protocol governance and benefit from it. However, concerns about centralization arise as certain protocols and exchanges dominate the staking landscape.

Figure 4

(Source: DeFiLlama)

When we analyze the staking market, we can see that a majority of ETH staking occurs through third-party services such as LSDs (36.8%) and centralized exchanges (21.4%). Independent staking makes up a majority of the ‘other’ category (29%) while staking pools (12.8%) are largely dominated by institutional grade staking services such as Figment.

Figure 5

(Source: DeFiLlama)

Lido dominates the liquid staking market, managing 31.7% of total staked ETH and over 86% of the liquid staking market. Coinbase, Binance, and Kraken collectively manage 19.5% of staked ETH, with Coinbase having the largest share (10.6%). Other institutional staking pool providers manage 9.5% of staked ETH. In total, the top 15 staking providers handle 69% of staked ETH, with the top 5 accounting for over 50%.

The Risks of LSDs

Consensus & Centralization

LSDs offer benefits but also carry risks. Concentrated chain consensus, where a few entities hold significant voting power, allows them to govern the network and potentially make malicious changes or self-serving proposals. Lido holds over 30% of on-chain voting, giving them substantial influence. Controlling a majority of consensus, can enable network manipulation and is viewed as the biggest achilles heel to blockchain networks, but did not pose a huge risk prior to LSDs.

Top LSD Protocols

Lido

Lido is the leading provider of liquid staking derivatives (LSDs), offering a simple way to earn rewards on your digital assets while keeping them liquid. Liquid staking simplifies the process, removes the need for hardware, and allows users to stake any desired amount. Lido's st[token] serves as a foundation for other protocols and applications, such as collateral for loans. Lido’s biggest market is currently Ethereum but they support a number of proof-of-stake networks and offer an alternative to solo staking, exchange staking, and other custodial options.

Figure 6

(Source: DeFiLlama, CoinGecko, as of 2023-05-01)

By depositing ETH, Lido stakers can participate in staking rewards and engage in DeFi using the stETH token. Lido's dominance in the LSD market is driven by the opportunities and partnerships associated with stETH, which has gained widespread adoption among DeFi providers. The stETH token seamlessly integrates into the role of conventional ETH tokens in DeFi while allowing users to earn a yield.

Rocket Pool

Rocket Pool is a decentralized staking protocol that offers liquid staking and node operator solutions for the Ethereum blockchain. It caters to users who lack the minimum required ETH for staking or the technical skills to run a node. Rocket Pool simplifies staking by creating mini pools with combined contributions from node operators (16 ETH minimum) and the rETH staking pool. This lowers the capital and technical requirements for node operators and allows users with smaller ETH quantities to participate in staking through the pool. Participants from the staking pool receive rETH tokens, representing their deposited ETH and aggregate staking rewards, which can be used in DeFi activities, such as lending, while still earning staking rewards.

Figure 7

(Source: DeFiLlama, CoinGecko, as of 2023-05-01)

Figure 8

(Source: DeFiLlama, CoinGecko, as of 2023-05-01)

FRAX Finance

Frax Ether is an ETH-based system that combines LSD and stablecoin features to simplify and secure the staking process. It offers a DeFi-native way to earn interest on ETH by leveraging the Frax Finance ecosystem. With Frax Ether, users can participate in ETH staking without the barriers of solo staking or the drawbacks of centralized exchanges. By using a liquid ETH staking derivative, users can earn yield easily, stake any amount of ETH, withdraw at any time, and enjoy greater composability in DeFi applications.

Frax operates with a dual-token model of ETH derivatives. The first derivative is frxETH, which is equivalent to 1 ETH and in itself does not receive staking rewards. The second token is sfrxETH which earns staking yield from the ETH used to mint frxETH. Users can exchange frxETH for sfrxETH to earn staking rewards proportional to their share of the staking pool. As staking rewards accumulate they are added to the staking pool increasing the value of the users staked position. What makes Frax unique is the flexibility of earning yield on their frxETH by choosing different sources within the FRAX ecosystem, such as the curve liquidity pool. As users opt for these alternative yield generating opportunities, the users who still choose to stake their frxETH in the staking pool will receive a higher yield due to others users forgoing their staking rewards in light of alternative opportunities.

Centralized Staking

In addition to decentralized staking options, centralized exchanges offer their users yield in exchange for staking ETH and other crypto assets on their platform.

Coinbase & Binance

Coinbase and Binance have introduced cbETH and bETH, respectively, as derivative staking tokens. These tokens function similarly to decentralized LSDs, representing the user's staked ETH position and are usable in other DeFi protocols. These tokens differ in that cbETH includes accrued staking rewards, increasing its value relative to ETH over time. In contrast, bETH is pegged 1:1 with ETH and does not incorporate earned staking rewards; Binance stakers receive additional bETH tokens as rewards, deposited to their spot accounts.

Figure 9

(Source: Dune, Coinbase. Binance, as of 2023-05-01)

Options

What are Crypto Options?

Options are financial derivatives that grant traders the right to buy or sell a specific asset at a predetermined price within a set timeframe. These instruments offer greater strategic flexibility and risk management for investors.

Crypto options provide an avenue for traders to utilize traditional trading strategies to mitigate volatility and settlement risks associated with cryptocurrency. Traders also use options to gain leverage, as contracts represent multiple shares of the underlying asset

The Value of Options

The significance of options lies in their ability to manage risk. By allowing predefined buying or selling prices, traders and asset owners can hedge against unfavorable price changes and capture potential gains without selling the underlying asset.

These advanced risk management solutions play a crucial role in attracting more participants to the cryptocurrency market. They reduce the associated long exposure risk to the assets, making digital assets more accessible to a wider investor base.

As institutional capital flows into the blockchain space and traders demand stronger risk management strategies, the crypto options market is poised to experience significant growth. By leveraging decentralized, highly liquid options order books on cost-effective and high-performing blockchain networks, a considerable portion of the centralized finance (CeFi) options market can be expected to transition towards decentralized protocols as

institutional grade, higher latency derivatives order books become available on the market.

Growing Adoption

Figure 10

(Source: The Block, as of 2023-06-18)

The crypto options segment for Bitcoin and Ethereum has shown a historical correlation between its volume and aggregated open interest with the price and growth of BTC and ETH during previous bull runs. Remarkably, despite unfavorable market conditions in the current bear market, this segment has experienced substantial growth in 2023. The volume and open interest levels have reached similar amounts as those observed during the all-time high of BTC and ETH prices in November 2021.

Several factors have contributed to this surge in demand for crypto options, including the increasing interest in cryptocurrencies, the rise of DeFi platforms, and the entry of sophisticated investors into the market. The availability of crypto options trading platforms has enabled users with lower capital and less expertise to participate, thereby leveling the playing field for investors of all types.

However, the dominance of centralized options desks, such as Deribit, is notable in this market. These centralized providers currently account for over 320 times more volume compared to decentralized providers. The suboptimal user experience of decentralized platforms is attributed to high transaction fees, low liquidity, and complicated vAMM (virtual automated market maker) pricing structures.

Despite the growth observed in the crypto options segment, its trading volume remains significantly lower than that of perpetual futures trading. Perpetual futures are favored due to their lower costs, ease of understanding, and provision of leveraged positions. On the other hand, options contracts offer settlement clarity and the ability to execute block trades.

Top Options Protocols

Lyra Finance

Built on Optimism, Lyra Finance offers a suite of smart contracts functioning as an automated market maker (AMM) for token options. Traders buy and sell options on cryptocurrency against liquidity pools. The Lyra AMM adjusts implied volatility based on demand to ensure accurate pricing of the options. Liquidity providers contribute sUSD or USDC to asset-specific Market Maker Vaults (liquidity pools) with no need to specify strike dates. Lyra Finance raised $3,300,000 in a seed round led by Framework Ventures, ParaFi Capital, and GSR.

Lyra Finance charges dynamic fees based on:

A flat fee based on the option price

A flat fee for exchanging costs

A dynamic fee based on the pool’s vega (exposure) risk

A dynamic fee depending on the markets’ volatility

Figure 11

(Source: DeFiLlama, CoinGecko, as of 2023-06-02)

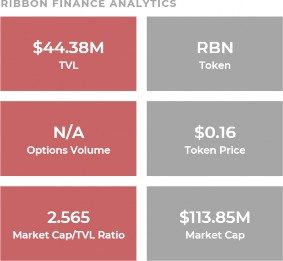

Ribbon Finance

Ribbon Finance acts as a one-stop solution for users to access crypto structured products, combining derivatives and an on-chain order-book options exchange (Aevo). Ribbon offers Theta Vaults, running an automated European options selling strategy, which earns yield on a weekly basis through writing out of the money options and collecting the premiums. The protocol also offers Ribbon Earn, fully funded strategies to capitalize on intra-week ETH movements, and Ribbon Treasury, private Ribbon Theta vaults for DAOs to run covered calls on their native tokens. Ribbon Finance raised $8,800,000 in a venture round led by Paradigm.

Aevo has a maker-taker fee structure:

Maker Fee: 0.03%

Taker Fee: 0.05%

Figure 12

(Source: DeFiLlama, CoinGecko, as of 2023-06-02)

Dopex

Dopex is a decentralized options protocol aiming to satisfy both option writer and option buyers through two protocol tokens, $DPX and

$rDPX. $DPX allows for governance and accrues protocol fees, while $rDPX is the rebate token to subsidize option writers’ losses. Dopex offers an AMM for European options and structured products, including Single Staking Options Vaults (SSOVs). SSOVs allow users to lock up tokens to provide options liquidity and earn a yield on their assets. Dopex raised

$7,500,000 in a public token sale ended June 2021.

Dopex charges 0.125% of the underlying amount, distributed towards the liquidity and staking pools.

Figure 13

(Source: DeFiLlama, CoinGecko, as of 2023-06-02)

Top Centralized Options Exchanges

Deribit Deribit is the leading cryptocurrency futures and options exchange, allowing traders to execute derivatives trading strategies for BTC, ETH, and SOL. Deribit dominates over 85% market share of the Bitcoin options markets and solely offers European style options. Deribit prices the options using the Black-Scholes model with an order-book. KYC is required to perform any activities and users from Japan, Canada, and the United States are restricted from the exchange. For BTC, ETH, and SOL options, Deribit uses a maker-taker fee model:

Maker Fee: 0.03% of the underlying

Taker Fee: 0.03% of the underlying

Figure 14

(Source: The Block, as of 2023-06-02)

Delta Exchange

Delta Exchange is an order-book options trading exchange for BTC, ETH, SOL, BNB, and 50+ altcoins. Delta offers vanilla options (European options), MOVE options (a straddle), and turbo options (exotic options with a knockout barrier). With KYC requirements, Delta Exchange is not available for residents of the United States, Ontario (Canada), and more. Delta also offers structured options products similar to DEXs, with over USD $6m in total value locked. Delta Exchange uses a maker-taker fee model:

Maker Fees: 0.03%

Taker Fees: 0.03%

Settlement Fees: 0.03%

calculated using the Black-Scholes model for reference. OKX has KYC requirements and is not available to US-, Canada-, and Bahamas-based investors. OKX uses a maker-taker fee model:

Maker Fees: 0.015% - 0.02%

Taker Fees: 0.03%

Figure 15

(Source: The Block)

OKX

OKX offers European cryptocurrency options for BTC and ETH, settled in the native coins. The platform is the second-largest cryptocurrency exchange by trading volume, with over 20 million users globally. OKX uses an order-book to transact options, while the mark price is

Figure 16

(Source: The Block, as of 2023-06-02)

Perpetual Futures

What are Perpetual Futures (“Perps”)?

Perpetual futures contracts, commonly known as "perps," are a specific type of derivative instrument. Unlike traditional futures contracts, which involve scheduled payment and delivery on predetermined dates, perps lack a fixed settlement date or exercise price. This means that traders can hold long or short positions indefinitely, as long as they meet the required collateral obligations. Perps offer the advantage of high leverage and facilitate trading in assets that may have limited liquidity.

Perps function based on a funding mechanism tied to the performance of the underlying asset. When the asset's price surpasses the contract price, long positions receive funding from shorts. This creates an incentive for users to acquire contracts, driving up the contract price and aligning it with the underlying asset's price. Conversely, when the asset's price drops below the contract price, the opposite occurs. As a result, profits and losses are continuously adjusted to reflect market conditions through this mechanism.

Our Thesis on Perps

In a relatively well-established and mature perpetual futures market, characterized by a fragmented yet substantial presence, its growth will closely mirror the overall trends of the cryptocurrency market. Persistent concerns regarding regulatory conditions and security vulnerabilities with exchanges, coupled with the presence of comparable offerings, lays the foundation for a shift towards decentralized exchanges. This transition may be motivated by a desire to bypass regulatory issues and prioritize self-custody.

Growing Adoption

Figure 17

(Source: The Block, as of 2023-06-08)

Perpetual futures for Bitcoin and Ethereum have demonstrated a historical correlation between the volume, aggregated open interest, and the price. Perps have gained popularity due to their straightforward and leveraged mechanism. Some exchanges provide perpetual futures with substantial leverage, up to 150x, attracting individuals with a high tolerance for risk.

Perpetual futures also serve as a hedging tool for market participants, including miners and investors. They can use perps to offset potential losses in their spot positions.

Compared to spot trading, perps allow for significantly higher leverage, potentially magnifying returns. Additionally, perp trading does not require custody of the underlying asset since it is not physically settled. This eliminates the need for custody solutions to store and secure crypto assets, enabling users to gain exposure to price movements without owning the actual asset.

Perps offer deeper liquidity compared to most options exchanges currently, leading to faster

settlement and minimized price impact. They provide cost-effective trading opportunities, requiring lower capital compared to other leveraged instruments. Moreover, perps do not have expiry dates, allowing traders to hold positions indefinitely and tend to have fairer pricing as they closely align with the spot price due to the funding rate mechanism. These characteristics contribute to the significant volume advantage perps enjoy over options.

Top Perps Protocols

GMX

GMX is a decentralized spot and perpetual trading platform that was first launched on Arbitrum in Sep. 2021, and later on Avalanche in 2022. It allows users to engage in spot swaps and trade perpetual futures with leverage of up to 50x. GMX distinguishes itself through its low swap fees, trades with zero-price impact, and limit orders, all of which focus on a more efficient trading experience. The protocol supports trading through a multi-asset liquidity pool, and it leverages Chainlink Oracles to aggregate price feeds from high-volume exchanges. As a decentralized exchange, GMX operates without an order book.

Fees on GMX consist of trading fees and platform fees. Trading fees vary on the asset traded, but tend to range from 0.02% to 0.05%. Platform fees include swap fees and a fee for using the decentralized exchange.

Figure 18

(Source: CoinGecko, DeFiLlama, as of 2023-06-08)

Gains Network (gTrade)

Gains Network is currently developing gTrade on Polygon, a decentralized leveraged trading platform renowned for its high liquidity efficiency, minimal trading fees, and leverage of up to 150x. Through a synthetic asset system utilizing a single GNS/DAI pool and a DAI vault to ensure liquidity, gTrade enables users to trade any asset supported by its oracles. As a decentralized exchange, gTrade allows users to retain custody of their assets, eliminating the need for an order book for each trading pair. Instead, gTrade relies on a custom Chainlink decentralized oracle network, delivering on-demand, on-chain spot prices to enhance the accuracy of trading data.

Spreads on BTC/USD and ETH/USD are fixed at 0.04%. For all other pairs, spreads are

dynamic depending on the price impact formula. Fees include:

Opening a trade: 0.08%

Updating a stop loss: 0.015%

Closing a trade: 0.08%

Figure 19

(Source: CoinGecko, DeFiLlama, as of 2023-06-08)

dYdX

Founded in July 2017, dYdX is a leading decentralized exchange that supports perpetual trading for 35+ cryptocurrencies, utilizing ZK-STARK Rollups. dYdX enables cross-margin trading, allowing users to utilize their available balance to provide liquidity and avoid liquidations during periods of high volatility. The platform employs a central limit order book matching engine and offers leverage of up to 20x. dYdX uses Chainlink oracles to obtain asset prices for the funding mechanism. Once the traders’ funds are deposited on Layer 2,

users no longer need to pay gas fees. Furthermore, dYdX is actively transitioning towards full decentralization with v4, which involves the development of its own blockchain on Cosmos.

dYdX uses a maker-taker fee model to determine its trade fees. Depending on the user’s monthly trading volumes, the fees are:

Maker Fee: 0% to 0.02%

Taker Fee: 0% to 0.05%

Figure 20

(Source: CoinGecko, DeFiLlama, TokenInsight, as of 2023-06-08)

Top Centralized Perps Exchanges

Binance

Launched in September 2019, Binance Futures has emerged as a leading crypto derivatives trading platform with a smooth trading experience. With its high trading volume, Binance is the most liquid platform available. Users can take long or short positions with perps on most major cryptocurrencies with up to 125x in leverage for specific pairs. Binance has implemented a insurance fund to protect its users. To manage risk and maintain price stability in high volatility, the platform employs measures such as adjusting the upper limit of the funding fee and reducing the funding interval to align the price of perps with the underlying asset.

Binance offers a maker-taker fee model for perpetual futures:

Maker Fees: 0.02%

Taker Fees: 0.04%

Figure 21 (Source: CoinMarketCap, as of 2023-06-08)

OKX Launched in January 2017, OKX offers crypto and USD-T margined perpetual swaps with a user-friendly interface. It supports a wide range of major cryptocurrencies and provides up to 100x leverage for select cryptocurrencies, such as BTC and ETH. With a strong emphasis on UX, OKX allows users to place orders by cost and offers a Futures Dollar-Cost Average bot to enhance risk management controls. The platform also provides a suite of trading bots to assist users in automating their trading strategies, giving them an advantage in volatile crypto markets. To mitigate the risk of massive liquidation, OKX forms an independent insurance fund pool for each perpetual swaps pair. OKX is not accessible to traders in the United States, Canada, and the UK. OKX offers a maker-taker fee model for perpetual futures:

Maker Fees: 0.02%

Taker Fees: 0.05%

Figure 22

(Source: CoinMarketCap, as of 2023-06-08)

Bybit

Launched in March 2018, Bybit offers perpetual trading for a wide range of cryptocurrencies and is distinguished by prioritizing user experience (UX). Bybit supports both USDT perps and inverse perps, allowing users to use native coins as the base currency. While transaction quantities are set with USD, margin, profit, and losses are all traded in the base currency. The platform offers traders the option to use either isolated margin or cross margin, and they can leverage up to 100x on their collateral.

To enhance user protection, Bybit employs an insurance fund that covers the gap and reduces the risk of auto-deleveraging during mass liquidations. However, due to regulatory constraints, traders from the United States, United Kingdom, Singapore, and Ontario are unable to access the Bybit platform.

Bybit offers a maker-taker fee model for perpetual futures:

Maker Fees: 0.01%

Taker Fees: 0.06%

Figure 23

(Source: CoinMarketCap, as of 2023-06-08)

Introduction to Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to another currency or asset. They offer stability, liquidity, and trust in the crypto space, serving as an alternative to volatile cryptocurrencies. Commonly pegged to the US Dollar, stablecoins bridge the gap between traditional finance and cryptocurrencies, facilitating transactions and value storage without exposure to volatility. They enhance cryptocurrency usability, encouraging adoption in areas such as remittances, cross-border transactions, DeFi applications, and other use cases where stability and ease of use are crucial.

Types of Stablecoins

There are multiple different types of stablecoins which differ in the way by which they achieve a stable peg to the asset they represent.

Fiat Backed Stablecoins

A fiat-backed stablecoin achieves its stability by being backed by a reserve of the corresponding fiat currency. This reserve is held by a trusted custodian, often a regulated financial institution, and is audited on a regular basis to ensure transparency and accountability. The reserve acts as collateral to support the value of the stablecoin, providing a 1:1 or close to 1:1 ratio between the stablecoin and the underlying fiat currency.

Collateralized Debt Positions (CDPs)

CDPs are a product offered by some stablecoin projects, such as MakerDAO. CDPs allow users to lock their crypto assets as collateral to

generate stablecoins. CDPs as the name implies serve as a loan where users can generate stablecoins up to specified fraction of the value of their collateral. However, CDPs incur debt and are subject to liquidation if the value of the deposited collateral falls below a predetermined ratio. If the value of the locked collateral falls to a point where the loan is under-collateralized, the assets will be liquidated to repay the loan.

Algorithmic Stablecoins

Algorithmic stablecoins are designed to achieve price stability and balance the circulating supply of an asset by being pegged to a reserve asset, such as the U.S. dollar, gold, or another currency. Unlike traditional stablecoins that rely on collateral assets, algorithmic stablecoins are uncollateralized and their value is not backed by an external asset. Instead, they utilize algorithms to monitor supply and demand and issue more coins when the price increases and buy them back when the price falls, aiming to prevent the stablecoin from deviating from its peg.

Two common models of algorithmic stablecoins are the "rebase" model, which adjusts the coin's supply based on its price deviation from the peg, and the "seigniorage" model, which involves a multi-coin system where one coin is designed for stability while others facilitate that stability through mint-and-burn mechanisms and market incentives. A newer model, known as fractional-algorithmic stablecoins, combines elements of both non-collateralized and collateralized stablecoins to maintain the peg.

Market Overview

The stablecoin market saw its peak near the end of the bull run in 2022 (Figure 25) and currently makes up over 10% of the entire crypto market cap. The stablecoin market cap typically runs inversely correlated to the price of bitcoin and the performance of the overall crypto market. However, we have also seen growth in stablecoin markets as the overall crypto markets have grown in size, in addition to a higher volume of funds moving into stablecoins during bearish periods in the crypto market. This is due to investors and network users beginning to de-risk and move their positions out of crypto and into more stable assets.

The stablecoin market is highly dominated by fiat-backed stablecoins such as Tether's USDT and Circle's USDC. Typically, fiat-backed stables are looked at in a better light and as less subject to volatility than other forms.

CDP Market

The CDP market makes up a fraction of the entire stablecoin market and its TVL has been subject to higher degrees of volatility due to the nature of its issuance (Figure 27).

Sudden market drops which have effects on the total value of the collateral supplied in CDPs can lead to many liquidations occurring and the total CDP market TVL fluctuating as a result.

The current market for CDPs is highly dominated by MakerDAO who have historically led the charge in the CDP market.

Top Providers in Each Category

Tether ($USDT) - Fiat Backed

Market Cap: $83.3B (2023-06-09)

Tether is the largest provider of stablecoins across all blockchain ecosystems with their USDT token making up nearly 65% of the entire stablecoin market cap. All Tether stable coins are fiat-backed meaning their value is upheld due to a 1:1 backing of fiat currency in Tether’s reserves. Tether provides routine audits of their reserves to ensure transparency and to instill confidence in investors that holding USDT is not subject to depegging or price fluctuations.

MakerDAO ($DAI) - CDP

Market Cap: $4.5B (2023-06-09)

MakerDAO pioneered the concept of Collateralized Debt Positions (CDPs) in the stablecoin market and currently dominates the sector with their DAI token holding over 70% of the total CDP market value. DAI is a decentralized collateral-backed stablecoin that aims to maintain a 1:1 ratio with the US Dollar. Users can generate DAI by locking collateral, such as ETH, into the MakerDAO protocol based on a predetermined liquidation ratio. If the value of the collateral falls below this ratio, the protocol liquidates it. When taking a debt position, MakerDAO requires users to swap their collateral for a derivative equivalent (PETH) to facilitate the liquidation process and stabilize the system.

FRAX ($FRAX) - Fractionalized Algorithmic

Market Cap: $1B (2023-06-09)

Frax is a unique stablecoin protocol that combines the characteristics of collateralized and algorithmic stablecoins. It employs a dynamic Collateral Ratio (CR) that adjusts based on market demand, ensuring stability and scalability. The protocol operates with two tokens: FRAX, the stablecoin, and FXS, the governance token. The collateralization ratio determines the blend of collateral and algorithmic stabilization backing 1 FRAX. To maintain its peg to the USD, Frax relies on deep liquidity pools, particularly the FRAX3CRV pool on Curve Finance. It calculates the prices of FRAX, FXS, and collateral using a time-weighted average of the Uniswap pair price and the ETH:USD Chainlink Oracle. This approach enhances stability and resilience. Frax v2 introduced Algorithmic Market Operations (AMOs) that automate the movement of FRAX and its collateral across the DeFi ecosystem. Various AMOs are used to optimize liquidity and stabilize the FRAX peg in a capital-efficient manner.

Overall, Frax represents an innovative experiment in algorithmic stablecoin design. Its fractional-algorithmic approach, integration with DeFi protocols, and automated market operations aim to create a stable and scalable on-chain money solution.

The Risks of Stablecoins

Stablecoins, like many things in the crypto markets, can also be subject to vulnerabilities or oversights in the way that they are created and seek to maintain their peg. Historically, there have been a number of crashes in the stablecoin market, some which were momentary, others which never recovered.

Terra USD Crash

In May 2022, a significant loss occurred in the stablecoin market when TerraUSD (UST), an algorithmic stablecoin, experienced a crash. The crash was caused by a breakdown in the balancing mechanism between TerraUSD and its sister currency, Luna. TerraUSD aimed to maintain a value of $1 by using a mechanism that involved burning TerraUSD to mint Luna and vice versa. However, changes to the interest rate offered by the Anchor Protocol, combined with the withdrawal of TerraUSD from Anchor, led to concerns among traders and a sell-off of TerraUSD and Luna. As a result, the balancing mechanism failed, leading to a drastic increase in the supply of Luna and a significant decrease in its value. This caused both TerraUSD and Luna to become nearly

worthless, resulting in substantial losses for investors.

USDC Depeg

While depegging of stablecoins has traditionally been associated with algorithmic stablecoins and stablecoins that attempt to maintain a peg without the necessary reserve collateral, these events have not been limited to this scope. While fiat-backed stablecoins have much less apparent risk in that they are collateralized by the assets they intend to mirror, these coins are much more centralized and rely on the systems that maintain the reserve currencies. In March 2023, the Silicon Valley Bank (SVB) experienced a run on the bank, leading to its collapse. Circle, the provider of USDC stablecoin, revealed that they had $3.3 billion of their reserves tied up in SVB. This news caused USDC to lose its $1 peg, reaching a low of

$0.87. However, SVB was eventually bailed out, and USDC returned to its original value. This event highlighted the risks associated with stablecoins that depend on the traditional financial system and the reliance on external entities for their security.

What is the DeFi Lending Market?

DeFi lending involves borrowing and lending digital assets on decentralized finance platforms through smart contracts without the need for intermediaries. Unlike traditional lending, DeFi lending eliminates the need for personal information and utilizes overcollateralization. In this system, borrowers provide collateral worth more than the loan they seek. Trust is established through liquidation mechanisms based on predefined ratios, removing reliance on borrower integrity or repayment capabilities.

What value does lending bring?

DeFi lending provides several value propositions. Firstly, it offers accessibility to anyone with an internet connection, allowing individuals from around the world to participate in lending and borrowing activities. Further, it eliminates the need for intermediaries, reducing costs and potential points of failure while also providing users with full control and ownership of their funds, as they are stored in personal wallets and managed through smart contracts. Additionally, overcollateralization reduces the risk of default and enables borrowers to access capital without needing to sell their assets. Variable interest rates change dynamically based on market demand, providing potential opportunities for lenders to earn higher returns and borrowers to access competitive rates.

Use Cases

The use cases for DeFi lending are really subjective to the borrower and what incentives they have to take out a loan against their collateral. Some users may use these protocols simply to borrow against a position they don’t

want to exit, however, there are a number of other common use cases that drive up the command for these decentralized loans.

Short Positions

DeFi lending enables users to take short positions against bearish assets. By providing collateral and borrowing the asset to be shorted, users can swap the borrowed tokens for stablecoins. As the price of the borrowed assets declines, the repayment amount decreases, allowing users to profit from the difference between stablecoin value and the falling repayment value. This strategy is commonly used in markets without perpetual exchange access.

Leverage

Loans can also be used to leverage asset positions. By supplying collateral (such as ETH) and borrowing stablecoins, users can swap stablecoins back to their original collateral to leverage their position. As the asset's price rises, users profit from both their collateral and the difference between their new leveraged position and the stablecoin loan. However, if the asset price falls and the loan reaches the liquidation mark, users risk losing their collateral and being left with a devalued position. Leverage allows users to amplify gains or losses in either direction.

Yield

Users can also take advantage of yield opportunities for different cryptocurrencies while holding their current positions. For example, if a user is optimistic about the price of ETH but wants to earn yield on stablecoins, they can supply ETH as collateral, borrow stablecoins,

and stake them to start earning yield. As the value of their collateral (ETH) increases and they earn yield on stablecoins, the risk of liquidation decreases. They can unlock their collateral by repaying the stablecoin loan and accrued interest at any time.

Lending Market

The overall lending market saw its highest levels of TVL during the end of 2021 and start of 2022 during which DeFi users were using loans to increase their potential returns on their capital or hedge against their position.

AAVE Aave is a decentralized non-custodial liquidity market protocol that allows users to participate as suppliers or borrowers. Suppliers provide liquidity to the market and earn passive income, while borrowers can borrow assets using collateral. To interact with the Aave protocol, users can supply their preferred asset and amount. By supplying assets, they will earn passive income based on the market borrowing demand, and can also use their supplied assets as collateral to borrow. The interest they earn from supplying funds helps offset the interest rate accumulated by borrowing. Aave is unique in that it provides support for a multitude of networks which currency include... ● Ethereum ● Polygon ● Avalanche ● Optimism ● Harmony ● Fantom ● Metis

JustLend JustLend is a TRON-based decentralized protocol that operates as a money market. It offers lending and borrowing services for TRON assets. Users can be suppliers or borrowers. Suppliers contribute assets to the protocol and receive jTokens in return, representing their share of pooled assets and earning interest. Borrowers provide jTokens as collateral and can borrow assets without specifying a loan expiration date. Interest rates for suppliers and borrowers are determined by market dynamics. JustLend exclusively supports the TRON blockchain.

Compound Compound Finance is a DeFi lending protocol where users can deposit crypto assets to earn interest or borrow against them. Deposits are converted into cTokens representing a share of the asset pool (ex. cETH). Interest rates adjust based on supply and demand dynamics, and COMP token holders can influence rates. Users earn interest by supplying assets and can borrow by providing collateral. Compound offers flexibility for earning interest and increasing leverage but carries risks. Currently Compound supports the following chains... ● Ethereum ● Polygon ● Arbitrum

NFT Lending Over the past couple of years, the NFT collateralized loan market has emerged as a new trend. It functions similarly to traditional DeFi loans but with NFTs as collateral. NFTs have lower liquidity compared to cryptocurrencies, driving demand for accessing capital tied up in NFTs. Users provide NFTs as collateral based on their floor value, and lenders provide liquid capital based on specified terms. If the NFT value falls below the liquidation ratio, the NFT is released to the lender. It allows lenders to enter NFT projects at a discount or earn interest on successfully paid back loans.

The total market for NFT lending has been on the rise since its inception near the start of 2022 (Figure 34). As the NFT market has cooled down since its peak in 2022, many traders are looking to loans to unlock the liquidity that is tied up in the NFT assets.

Top Protocols

BendDAO

TVL: $170.65M

BendDAO is a decentralized protocol that offers NFT liquidity solutions. It enables NFT holders to borrow ETH instantly using their NFTs as collateral and allows depositors to earn interest by providing ETH liquidity. Sellers can also

receive instant liquidity by listing their NFTs and receiving a portion of the floor value upfront. Buyers can make purchases with a down payment and repay the borrowed amount through the platform. BendDAO offers benefits such as 24-hour liquidation protection, airdrop rights for borrowers, and secure conversion of NFTs into boundNFTs. It serves as a one-stop solution for NFT liquidity needs

The Future of DeFi

DeFi has the potential to revolutionize financial systems and provide value to underserved communities globally. We believe that as DeFi continues to evolve, this global access will only increase as current barriers to entry and capital inefficiencies are mitigated. With this constant evolution of DeFi protocols and the innovative takes that new entrants are beginning to display, there are a number of specific key areas and product markets that we are excited about looking forward.

Undercollateralized Lending

Undercollateralized lending protocols that would offer lending alternatives without the need to provide collateral of greater value than the loan being taken is an area that we believe has high potential and the ability to steal market share from current leading lending protocols. These protocols would allow DeFi users to take loans of greater value than their capital (leveraged) which would provide an opportunity and greater access to capital that current lending protocols would be unable to match.

High Latency Order Books

The prevalent automated market maker model, while innovative, faces limitations in terms of MEV exploits and slippage. These challenges restrict the model's scalability, particularly in the realm of derivatives trading where precision, speed, and minimal transaction costs are vital. A high-latency exchange can help mitigate these issues by providing a batching mechanism that allows transactions to be processed in groups rather than a continuous, each-for-its-own manner, as in AMMs. This approach improves scalability, minimizes front-running opportunities, reducing MEV concerns and ensuring fairer pricing. It also curbs slippage by aggregating liquidity over a longer time scale, thereby improving price stability. As such, a high-latency exchange is a critical requirement for DeFi to realize its potential, especially in the field of decentralized derivatives trading.

Cross-chain Liquidity

Protocols that would merge liquidity from multiple ecosystems in a unified liquidity layer are another area that could enhance the current landscape of DeFi. Current DeFi market liquidity is extremely segmented, therefore, by producing a solution that allows for liquidity to be used cross-chain, DeFi protocols would benefit from greater liquidity pools leading to less volatility and a greater access to capital.

Tokenization of Real World Assets (RWA) Until recently, DeFi has been restricted to blockchain assets which have their own set of risks. However there has been a strong effort in recent years to tokenize other financial assets on-chain. Examples include tokenized treasury bills, leases and accounts receivable, fractional real estate, private debt and more. This is an area that has developed in DeFi, but has also seen great institutional interest: Goldman Sachs and JP Morgan have already tokenized over half a billion dollars of assets with plans to onboard significantly more in the future. Improvements in attestation and custody infrastructure will continue to drive growth in this subsector.